April 2025 monthly investment news

Last month, concerns over economic growth and the introduction of new tariffs had a significant impact on global financial markets. In this investment review, we look at how markets performed.

The US imposed a 25% tariff on imports from Canada and Mexico and increased tariffs on Chinese goods, prompting immediate retaliatory measures. These developments, combined with uncertainty surrounding the upcoming ‘Liberation Day,’ caused considerable volatility in global markets, leading to notable declines in many major indices.

Equity markets closely monitored short-term events in Washington, trading down with occasional rebounds. Europe’s macroeconomic situation improved, with Germany’s €500 billion infrastructure fund potentially boosting broader European growth.

Bond yields climbed higher, driven by a less dovish Federal Reserve, while commodities demonstrated strong performance with strength in Copper and Gold.

Market activity

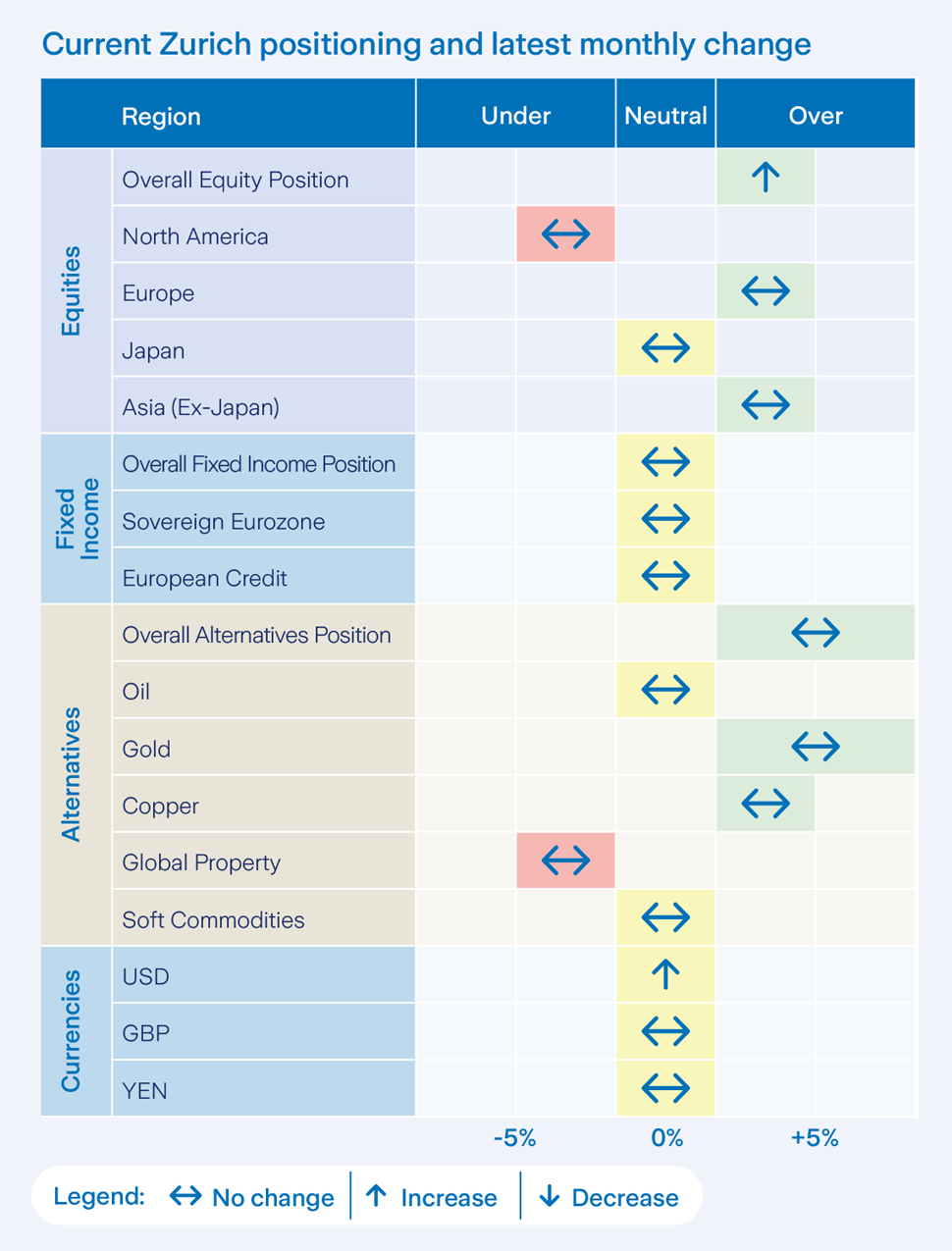

At the beginning of March, we increased our equity holdings in the Active Asset Allocation fund. The purchases were funded from short term bonds. We also removed our USD hedge, resulting in a broadly neutral USD position.

Additionally, we increased our allocation to long-term bonds several times over the month, funded by short bonds. Our current positioning is overweight equities and broadly neutral in our allocations to fixed income. We maintain an overweight position in Gold and Copper in the Prisma funds.

Equity markets performance

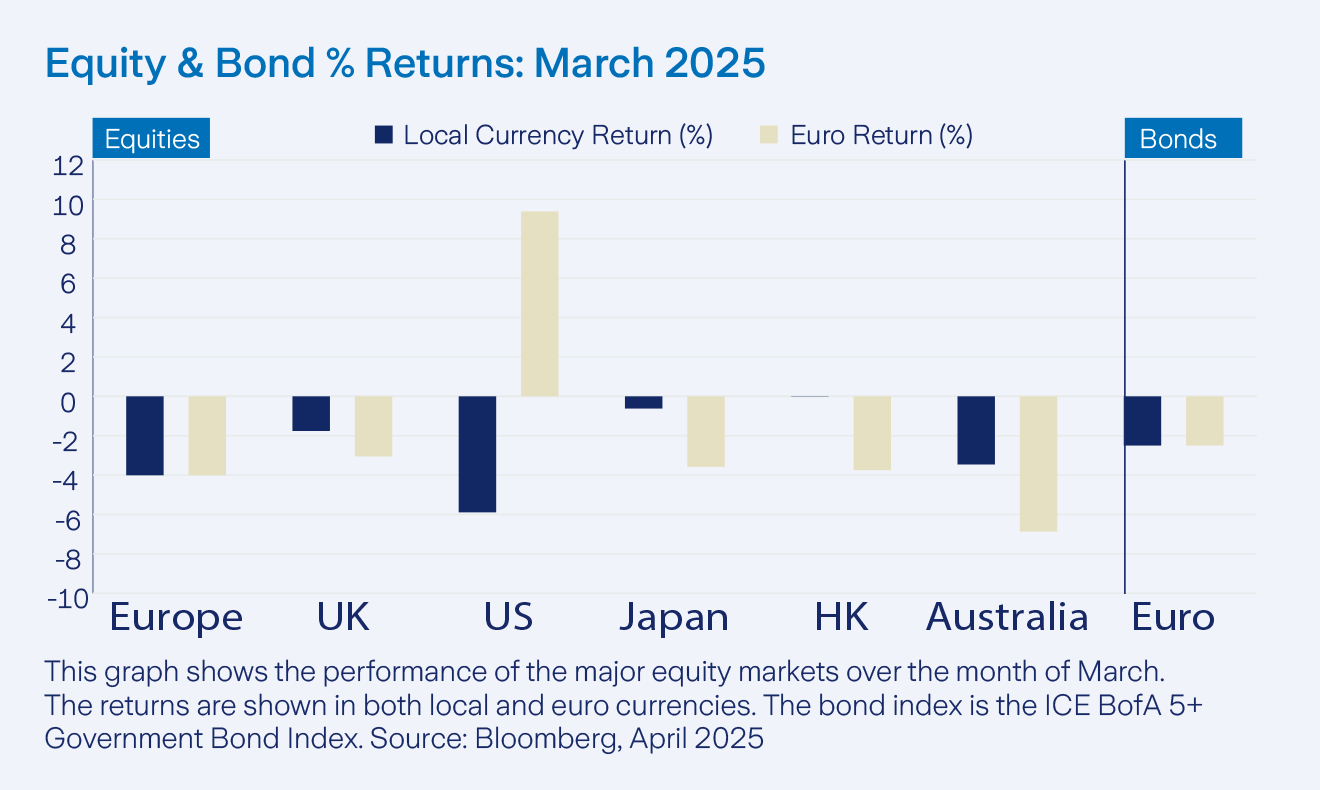

In March, global equity markets experienced a widespread decline. This downturn was driven by concerns over US economic growth, uncertainty regarding tariffs, and the impact of rising bond and credit yields.

Ten out of the eleven MSCI sectors closed the month in negative territory. Investors gravitated towards defensive sectors, with Energy being the sole sector to post a positive return of 0.3%.

Technology stocks were hit particularly hard by market volatility, recording a return of -12.6% for the month. European equity markets fared slightly better but still ended the month in negative territory, as investors continued to seek alternatives to US markets.

Bonds and interest rates

In March, bond market experienced notable fluctuations due to policy and tariff uncertainty and shifting investor sentiment. The US 10-year Treasury yield rose to as high as 4.36% during the month as the Federal Reserve maintained a cautious stance amid persistent inflationary pressures despite a cooling labour market.

In Europe, Germany’s announcement of significant fiscal spending to boost economic growth led to a surge in long-term bond yields, with the German 10-year yield rising to 2.74% at month end up from 2.41% in February.

The ECB lowered its key interest rates by 25bps, reducing the deposit facility rate to 2.50%. Euro Area inflation eased to 2.2% in March, the lowest since November 2024.

Commodities and currencies

Commodity markets generally performed well in March. Fears of trade wars and potential recessions led investors to seek ‘safe’ assets, driving gold prices above $3,000/oz for the first time on March 14th and continuing to new highs.

In Euro terms, gold returned over 4.8%. Copper also saw strong gains, with concerns that President Trump might impose tariffs on copper imports to the US, with copper returning 3.4% in USD terms. By the end of March, the Euro appreciated against the US dollar, with 1 Euro purchasing 1.0816 USD, up from 1.0375 in February.

Warning: Annual management fees apply. The fund growth shown below is before the full annual management charge is applied on your policy.

Warning: Past performance is not a reliable guide to future performance.

Warning: Benefits may be affected by changes in currency exchange rates.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in these products you may lose some or all of the money you invest.

Related articles

Filter by category

Follow us on

Sending Response, please wait ...

Sending Response, please wait ...

Your response has been successfully submitted.

An error has occurred attempting to submit your response. Please try again.